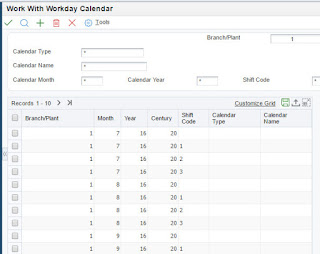

When you type a date in JDE, and you don't type the first two digits of the year (century - CTRY in JDE) the system complements the date.

Example:

You type the next value: 05/15/16 ==> system translate as May 15, 2016

You type the next value: 05/15/98 ==> system translate as May 15,1998

You can change this setup if you want:

P92001 - Work with data dictionary Items - Work with data items

There are two data items:

- CENTCHG

- DCYR

You need to change the default values of this items:

In this case the system work in the next way:

39 ==> 2039

40 ==> 2040

41 ==> 1941

You need to deploy this DD items on servers.