Check out the date pattern of your company,

2. P0008 - Work With Fiscal Date Patterns

Check the existence of the previous fiscal date patterns for the new year,

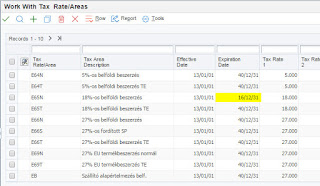

4. P00146 - Work with Due Date Rules

Check out the calendar values of the due date rules.

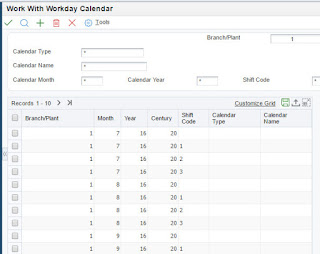

5. P00071 - Work With Workday Calendar

Check the existence of the work day calendar. (previous business units in the calendar fields)

Check out the calendar values of the due date rules.

5. P00071 - Work With Workday Calendar

Check the existence of the work day calendar. (previous business units in the calendar fields)

6. NN - P0002

Form ==> NN by CO/FY

Check out your next numbers.

7. R098201 - Annual Close report

Creates account records in the F0902 table for the new fiscal year, and updates balance forward fields and prior year-end net postings fields. Calculates and posts retained earnings.

8. R12825 - Asset Account Balance Close

Have you problems with depreciation calculation?

Run Asset Account Balance Close to create the next year's balance records with cumulative and net balance forward amounts. The Asset Account Balance Close program also carries forward depreciation information to the next fiscal year. You must run Asset Account Balance Close for the current year before the system can generate depreciation journal entries for the next fiscal year.

Form ==> NN by CO/FY

Check out your next numbers.

7. R098201 - Annual Close report

Creates account records in the F0902 table for the new fiscal year, and updates balance forward fields and prior year-end net postings fields. Calculates and posts retained earnings.

8. R12825 - Asset Account Balance Close

Have you problems with depreciation calculation?

Run Asset Account Balance Close to create the next year's balance records with cumulative and net balance forward amounts. The Asset Account Balance Close program also carries forward depreciation information to the next fiscal year. You must run Asset Account Balance Close for the current year before the system can generate depreciation journal entries for the next fiscal year.

No comments:

Post a Comment